losandes.biz: Tiktoks Project S in the Southeast Asian Market Competition

Dalam era yang terus berkembang dengan pesat, informasi telah menjadi komoditas yang tak ternilai harganya. Dari revolusi digital hingga transformasi teknologi, dunia kita kini tenggelam dalam lautan informasi yang tak pernah kering. Artikel ini mengajak kita untuk melangkahkan kaki ke dalam kompleksitas tatanan informasi saat ini, mengeksplorasi tantangan dan peluang yang muncul dalam mengelola dan memahami gelombang informasi yang terus menggulung. Dari algoritma cerdas hingga arus berita yang tak kenal lelah, mari kita telaah bersama bagaimana kita dapat menjadikan informasi sebagai alat untuk mendobrak batasan dan memahami dunia di sekitar kita dengan lebih baik.

Berikut adalah artikel atau berita tentang Harian losandes.biz dengan judul losandes.biz: Tiktoks Project S in the Southeast Asian Market Competition yang telah tayang di losandes.biz terimakasih telah menyimak. Bila ada masukan atau komplain mengenai artikel berikut silahkan hubungi email kami di [email protected], Terimakasih.

Viewed from the perspective of market opportunities, based on data from the Indonesian Internet Service Providers Association (APJII), national internet penetration reached 78.19 percent. If calculated from the total population, there are around 215.6 million internet users in Indonesia in 2023.

Large internet service users are linear with very high potential economic value. Referring to a report entitled “Shoppertainment: APAC’s Trillion-Dollar Opportunity” published by Tiktok in collaboration with the Boston Consulting Group in 2022, it indicates that there is such a large potential for the digital trading market. In the 2022 period, the Asia Pacific region recorded the value of commodities sold through e-commerce and shoppertainment platforms reaching US$3.1 trillion. The proportion of the market value of shoppertainment itself is in the range of 500 billion US dollars. In the same report document, the market potential for shoppertainment in 2025 is predicted to reach 1.1 trillion US dollars.

Shoppertainment and e-commerce platforms have different characters. Even though they are both selling online, shoppertainment is conceptualized as more interesting and wrapped in entertainment. This definition relates to online trading activities that are driven by content on social media that is entertaining and educative. Shoppertainment marketing tends to subtly influence potential buyers by utilizing digital content so that it doesn’t appear to be forcing (hard selling) the audience to buy a product.

Also read: ”Project S” Tiktok is Coming, How Big is the Threat?

Currently, the biggest shoppertainment area is only on Tiktok. The market potential that can be tapped by Tiktok Shop in Indonesia is huge, reaching 113 million users. This figure is ranked the second largest in the world after United States citizens who reached 116.5 million users.

Specifically for Indonesia, the number of visitors to marketplaces (marketplaces) operating in Indonesia is not far from active Tiktok users. Referring to data from SimilarWeb, in the first quarter of 2023 the number of visitors Shopee as the first ranking marketplace in Indonesia recorded 158 million visitors per month.

Then followed by Tokopedia with 117 million visitors, Lazada in third place (83.2 million visitors), Blibli (25.4 million visitors), and finally Bukalapak (18.1 million visitors). It is conceivable if most of Tiktok’s active users switch to shopping through the Tiktok Shop, it will massively change the competitive landscape of the e-commerce platform. In fact, even those online marketplaces will likely find it difficult to match Tiktok.

Competition map

The competition between Tiktok Shop and other e-commerce platforms, such as Shopee, Lazada, Tokopedia, Blibli, and Bukalapak, cannot be considered equal. This is because the main activities of their user audiences are different. Tiktok relies on a group of social media users who have been attracted through short video formats. Meanwhile, e-commerce platforms are created to cater to users whose main goal is to shop.

Indeed, in its development, e-commerce platforms have features that are similar to TikTok Shop. Shopee’s local marketplace began launching Shopee Live on June 6, 2019. Likewise, Tokopedia offers Tokopedia Play Live Shopping services ahead of Ramadan 2020. Judging from its timeline, TikTok Shop is actually the youngest as it was only introduced in April 2021. However, in its development, TikTok Shop has shown aggressive growth.

Also read: Tiktok Becomes a Serious Threat

One of the brands in Tiktok Shop

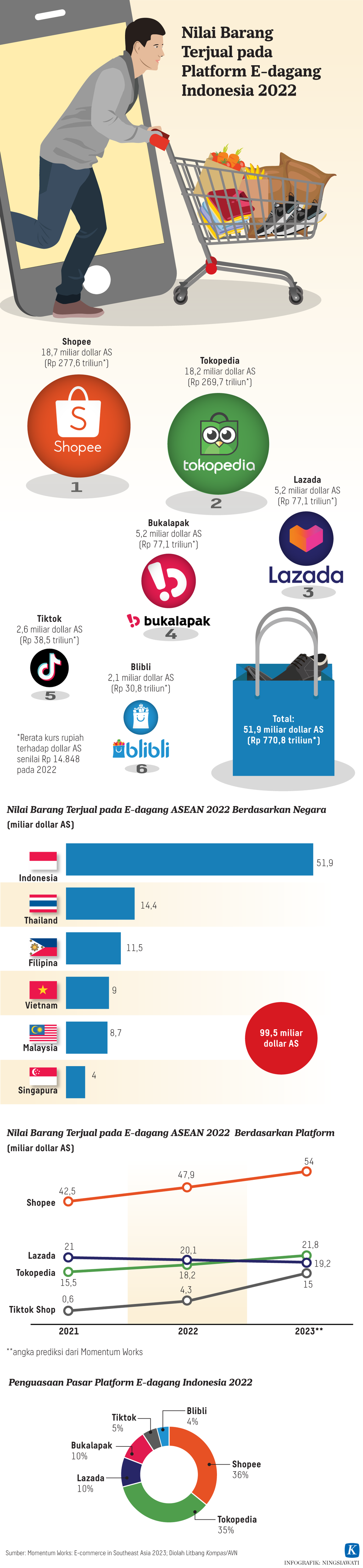

Referring to a report published by Momentum Works, a business and technology consulting firm entitled “E-commerce in Southeast Asia 2023”, it was found that sales of products through Tiktok Shop are growing rapidly. In the 2021 bookkeeping, in its launch year, Tiktok Shop specifically in Southeast Asia was able to distribute products worth 600 million US dollars. In the following year, it skyrocketed to the level of 4.3 billion US dollars, or a seven-fold increase from the previous year. Based on these achievements, Momentum Works predicts that by 2023, the value of transactions through Tiktok Shop has the potential to close the book at 15 billion US dollars or around IDR 225 trillion.

Based on the transaction value of Tiktok Shop in 2022, it is still a long and challenging path for Tiktok Shop to compete with the top three marketplaces in Southeast Asia. During that period, the top position was held by Shopee with a sales value of 47.9 billion USD, followed by Lazada with sales of 20.1 billion USD.

Shopee is ranked first as the best-selling e-commerce (e-commerce) in six ASEAN countries. The six countries are Indonesia, Malaysia, Singapore, Thailand, Vietnam and the Philippines. While Lazada is in second place except in Indonesia because the second place in Indonesia is filled with Tokopedia with a transaction value of 18.2 billion US dollars. Tokopedia is the third largest marketplace in Southeast Asia based on transaction value.

Although the gap between Tiktok Shop’s competition with top local markets in Southeast Asia is still wide, projections show how the distance of competition is getting thinner. It is highly possible that in the next two or three years, Tiktok Shop can rise to third or even second place in the local market share. To achieve this, Tiktok Shop plans to initiate unique and even controversial maneuvers.

Behind “Project S”

Also read: ”Shoppertainment” on Social Media is soaring, consumer protection needs to be maintained

Traders are interacting with the audience during a live TikTok broadcast while selling their products online at Block A Tanah Abang stalls in Jakarta on Tuesday (13/6/2023).

In fact, this effort is not the first one carried out by Bytedance. The Douyin social media platform, which is the domestic version of Tiktok in China, has already implemented a similar business model. It is noted that the business model applied to Douyin is able to generate transactions worth more than 10 billion US dollars per year. This is seen as a success that will be adopted in Tiktok.

Threats to Indonesia

If implemented in Indonesia, it has the potential to threaten the survival of micro, small, and medium-sized enterprises (MSMEs). Sectors at risk include retail traders who manage online stores and manufacturers who sell their products online. Products produced by Chinese manufacturers will be easier to attract consumers because they are cheaper with better quality due to advanced technology support.

Read also: Government Resets E-commerce

MSME players in Lampung tried live TikTok to promote their products on Friday (16/6/2023). This marketing campaign was assisted by college students.

One proof of weak competition can be seen in 2021, when Shopee sells products imported directly from China. The merchant account is not in Indonesia. At that time, there were dozens of products that were prohibited by the government from being sold on Shopee if the products were imported from China. Prohibited products are apparel (Kompas, 19/5/2023). Economically, such a trading model will of course benefit domestic consumers because they can buy quality products at affordable prices. However, for businesses or industries that are affected it can be very detrimental competition.

Regarding this phenomenon, Minister of Cooperatives and Small and Medium Enterprises Teten Masduki conveyed that the potential protection from foreign trade amounted to around IDR 300 trillion per year. Reflecting on that experience, the government needs to be vigilant and mitigate the risk of national economy being threatened by the entry of imported products with very low prices.

The government must provide protection and also protection for domestic businesses so that they are not eroded by the massive digital market that is pushing in from all directions. The large market in Indonesia should bring prosperity to the nation itself. (R & D COMPASS)